net investment income tax 2021 calculator

B the excess if any of. Long-term capital gains are gains on assets you hold for more than one year.

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

1 It applies to individuals families estates and trusts.

. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. We do not calculate the potential tax consequence. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

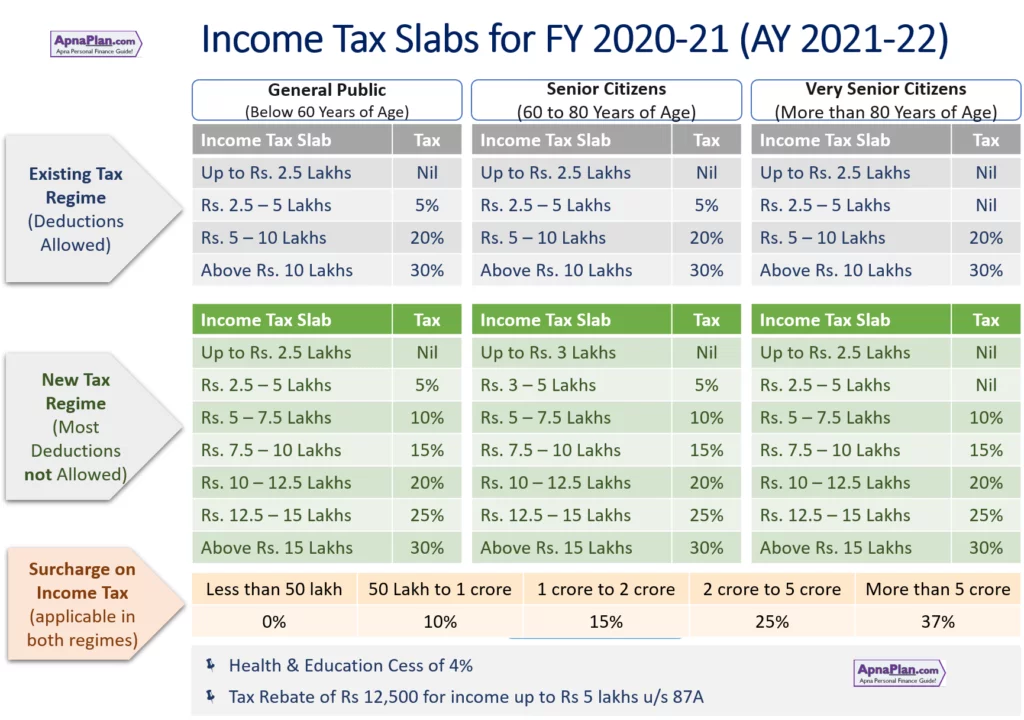

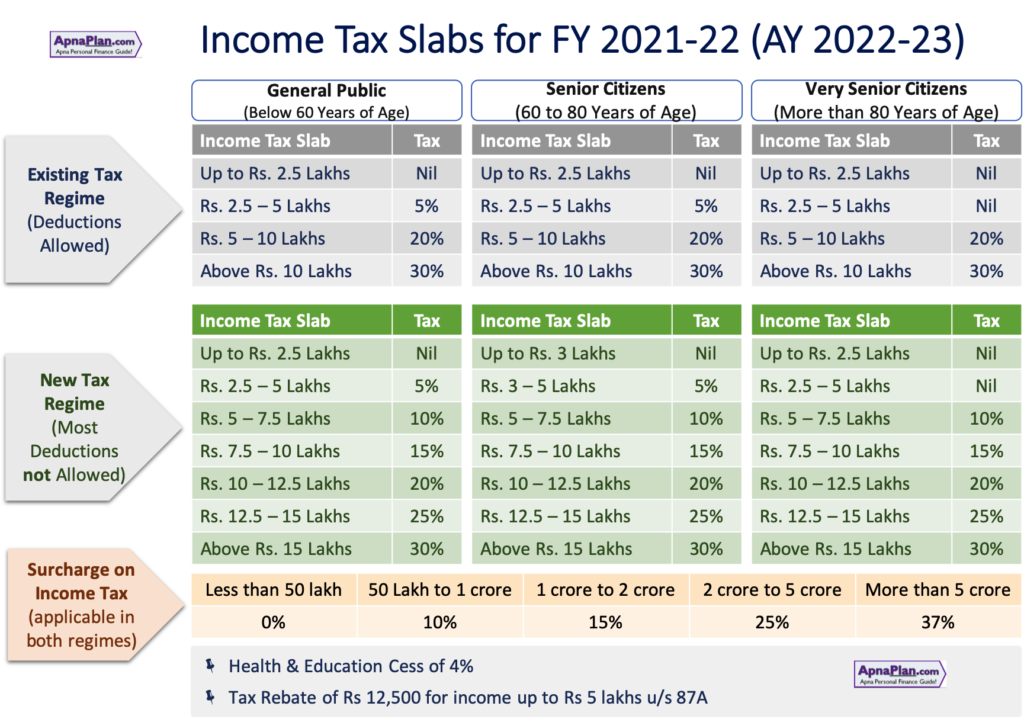

Theyre taxed like regular income. The net investment income tax applies to taxpayers who have a significant amount of investment income typically high-net-worth families and individuals with considerable. Additionally health and education.

A the undistributed net investment income or. Calculate Your Potential Investment Returns With the Help of AARPs Free Calculator. This calculator reflects the Metro Supportive Housing Services SHS Personal Income Tax for all OR county residents on taxable income of more than 125000 for single.

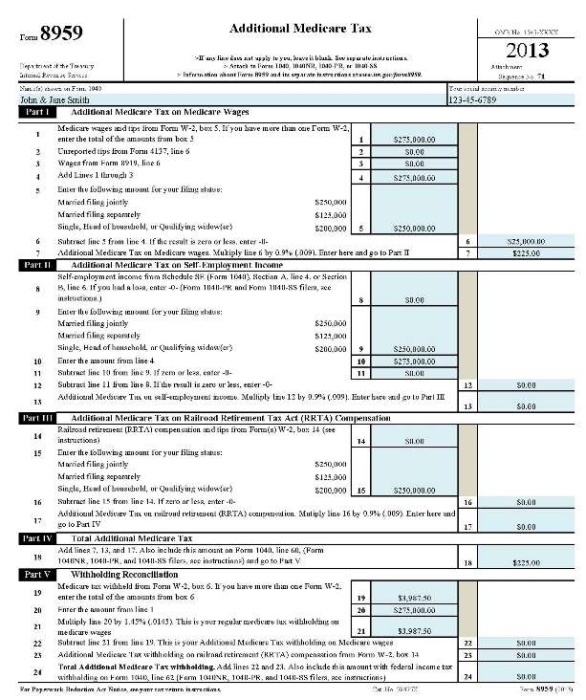

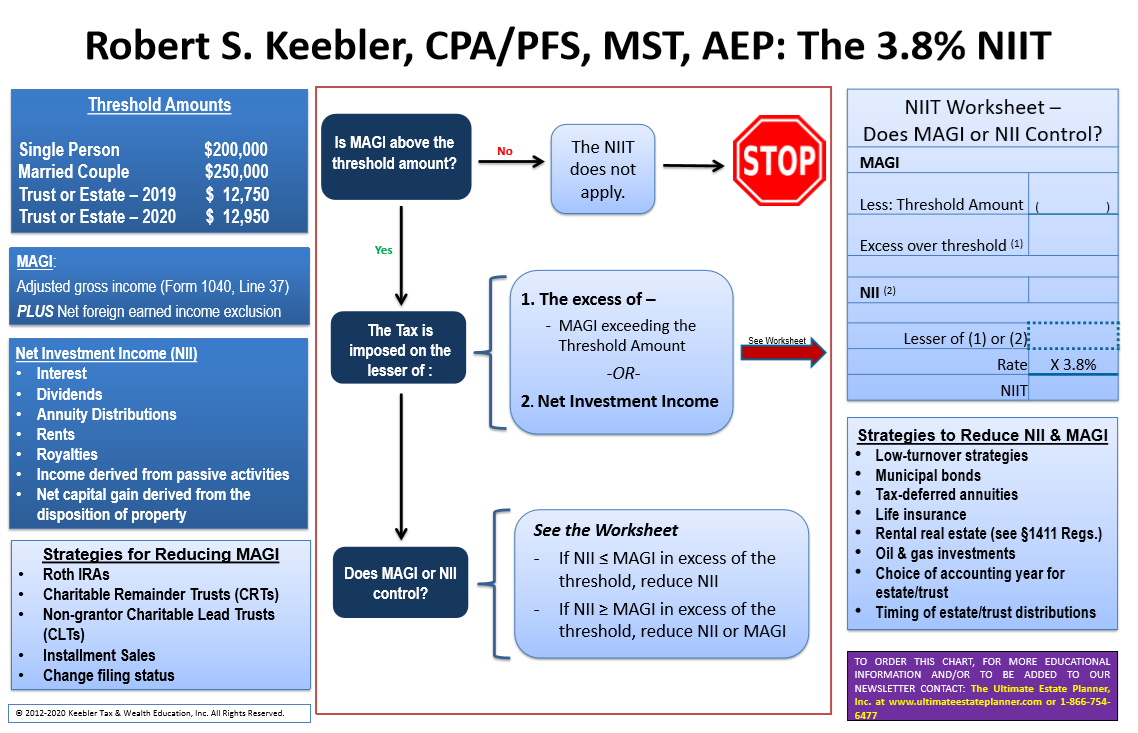

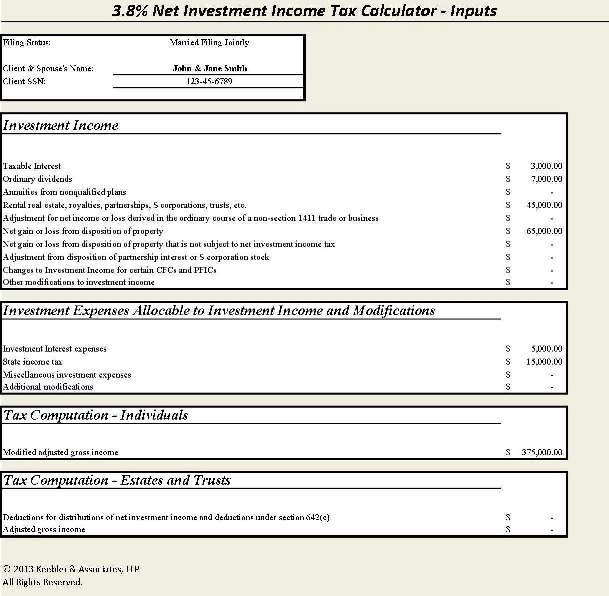

A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. For more information on the Net Investment Income Tax refer to Tax.

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. For example to calculate the return rate. Overview Data and Policy Options Since 2013 certain higher-income individuals have been.

Youll owe the 38 tax. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted. Your net investment income is less than your MAGI overage.

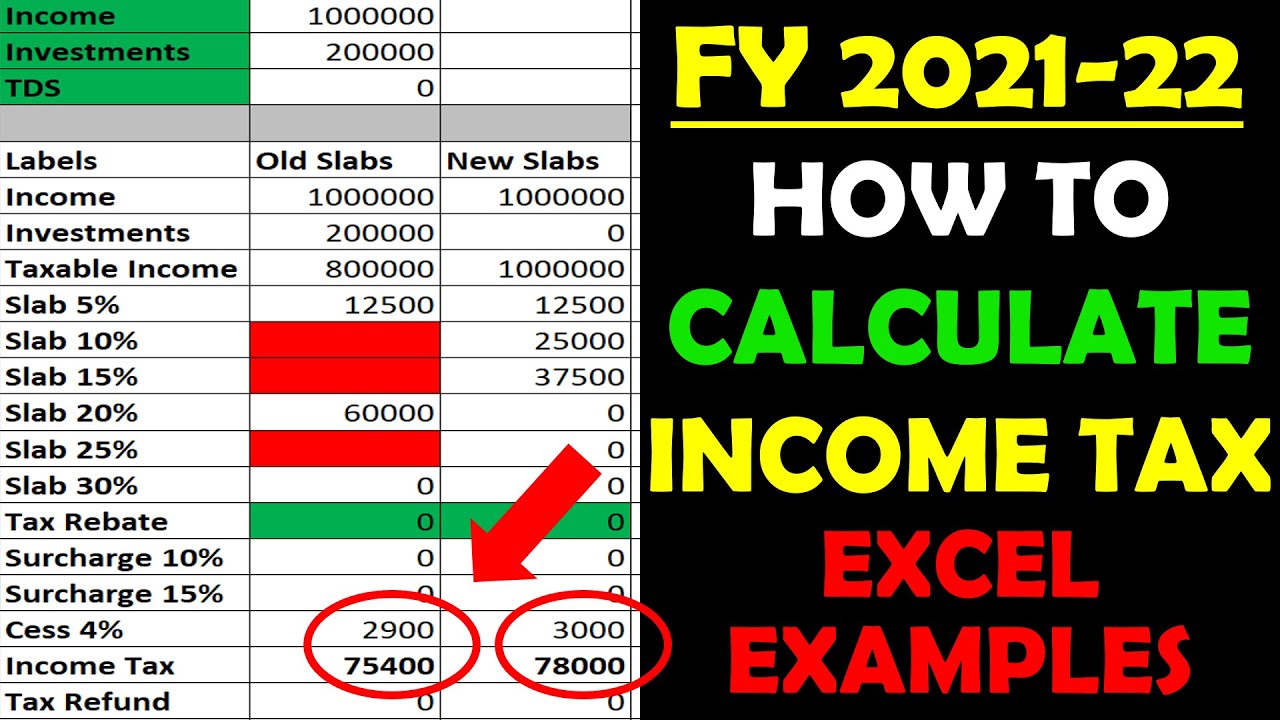

The net investment income tax calculator is for a person who has modified adjusted gross income more than the threshold and also investment income. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. These rates are applicable for the assessment year 2022-23 during which taxes for the year 2021-22 are determined.

Ad Understand The Potential Returns You Might Receive From Investments. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. In the case of an estate or trust the NIIT is 38 percent on the lesser of.

Capital gains tax rates on most assets held for a year or less. Once you are above these income amounts the Net Investment Income Tax goes into effect. That means you pay the same tax rates you pay on federal income tax.

If your net investment income is 1 or more Form 8960 helps you calculate the NIIT you owe by multiplying the amount by which your MAGI exceeds the applicable threshold. We are only required by the IRS to indicate annuity distributions. Married filing jointly.

The adjusted gross income. The tabs represent the desired parameter to be found. If an adjustment is needed to the beneficiarys net investment income for section 1411 net investment income or deductions see below a manual adjustment will need to be made on.

For example- for the financial year 2021-22 the net taxable. The Investment Calculator can be used to calculate a specific parameter for an investment plan. To calculate the NIIT lets first look at the statutory threshold amounts.

Distribution of Net Investment Income. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. The formula for calculating tax percentage is total tax payable divided by the total net taxable income for the financial year.

April 28 2021 The 38 Net Investment Income Tax.

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

How To Calculate Income Tax Fy 2020 21 Examples New Income Tax Calculation Fy 2020 21 Youtube

Tax Calculator Estimate Your Income Tax For 2022 Free

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help Income Tax Income Tax

2021 Estate Income Tax Calculator Rates

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Calculate The Net Investment Income Properly

Net Investment Income Tax Calculator The Ultimate Estate Planner Inc

Income Tax Calculator Fy 2021 22 Calculate New And Old Regime Tax

Net Investment Income Tax Calculator The Ultimate Estate Planner Inc

2021 2022 Income Tax Calculator Canada Wowa Ca

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

How To Calculate The Net Investment Income Properly

Net Investment Income Tax Calculator The Ultimate Estate Planner Inc

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe